天软金融分析.NET函数大全 > 金融函数 > 债券 > 债券收益率

BondYieldToMaturity3

简述

规则付息且非最后付息周期债券的到期收益率中间函数。付息次数处理—完整周期采用+1,非完整周期计算比例。(非完整周期主要是首个周期以及最后付息周期)。定义

BondYieldToMaturity3(PV:Real;CashFlow:Array;f:int;d:int;TS:int):Real

参数

| 名称 | 类型 | 说明 |

|---|---|---|

| PV | Real | 实数,债券全价

CashFlow:数组,未来现金流数据,字段见现金流返回值。 f:整数,频率 d:整数,债券结算日至下一付息日之间的实际天数(含2月29) TS :整数,当前付息周期的实际天数(计息日为基准,含2月29) |

| 返回 | Real | 实数,到期收益率。 |

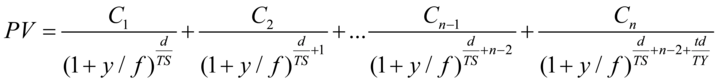

- 算法

其中,Ci:每期现金流;

td:债券最后一期计息起始日到到期日天数(含2月29)

TY:债券最后一期完整周期天数(非完整周期表示最后一期计息起始日到下一虚拟付息日天数,含2月29)范例

已知某个固定利率周期性付息债券在20171220T全价102.5,频率为1,未来现金流数据如下所示:计息起始日 付息日 本期付息 本期利率(%) 本期付本金 剩余本金 现金流 20171028T 20181028T 3.5 3.5 0 100 3.5 20181028T 20191028T 3.5 3.5 50 50 53.5 20191028T 20201028T 1.75 3.5 50 0 51.75

求持有到期的到期收益率Endt:=20171220T;返回:0.0261321222858299

BondCash:=array(("计息起始日":20171028T,"付息日":20181028T,"现金流":3.5),

("计息起始日":20181028T,"付息日":20191028T,"现金流":53.5),

("计息起始日":20191028T,"付息日":20201028T,"现金流":51.75));

t:=BondCash[0,"付息日"]-Endt;

TS:=BondCash[0,"付息日"]-BondCash[0,"计息起始日"];

PV:=102.5;

f:=1;

Return BondYieldToMaturity3(PV,BondCash,f,t,TS);

相关